S&T AG: On Monday, 28th of September 2020, a UK based analyst firm has issued a short recommendation on the S&T AG share (ISIN: AT0000A0E9W5, WKN: A0X9EJ, SANT). The short recommendation includes various concerns on the S&T Business Model, its operational performance, its financial situation, its exposure to certain geographies, on the Auditor engagement, on corporate governance and others. The short recommendation does not include any legal or criminal allegation against S&T. S&T is taking the points raised very seriously and hereby addresses them as follows:

1.

S&T’s Business Model: The short recommendation challenges the S&T business model in respect to its complexity and sees it as low margin business: S&T started its business originally as IT Services Provider predominantly in Eastern Europe and Austria, while the merger with Quanmax AG in 2012 added classic own IT Products (PCs, Notebooks, Servers) and first own IoT technologies in the area of industrial firewalls. In 2012 lower level IT Products plus IT Services represented 89% of the S&T business. Since then, S&T has been a company in transformation: while constantly adding new own technology products, both via internal R&D and M&A, S&T reduced, divested or closed non-strategic areas such as the own IT product business in 2016. In the FY 2019, already 55% of our revenues and 70% of our EBITDA were generated by our IoT Segments – from our perspective not a low margin business. With our Agenda 2023 and our upcoming Vision 2030 this transformation process will be continued and executed.

2.

S&T technology: the analyst claims S&T is rather an IT services business with limited own technology: from our total staff of 4.934 FTE (31.12.2019), 2.649 FTE are engineers increasing and improving our products constantly. In FY 2019 we spent EUR 170 Mio. for our engineer’s salaries. The short recommendation states that the different bits and pieces acquired are no solid foundation for building a global scalable IoT Platform allowing S&T to compete with big players like SAP. That is in so far correct, as it was never the target of S&T to compete against the big players on mass markets, but be a technology leader in selected vertical (niche) markets like railway control communication, medical systems, avionics and others, which have similar underlying technology building blocks in the area of communication, security and software. These technologies include:

- SUSiEtec, TSN and Embedded Hardware for smart factories to connect machines (ABB, Kuka, Hauser);

- GSM-R communication to control high speed trains (SNCF, Network Rail Technologies, Deutsche Bahn Netz);

- Medical Systems for Dräger, Philips, Maquet, GEHC, where we are qualified from government perspective as mission critical supplier;

- Real Time Embedded Edge Computing for Autonomous Driving (Lyft, Autoliv);

- Avionics “Flynet” connectivity system (Air China, Lufthansa, Immarsat).

We understand that this broad portfolio adds complexity, on the other side it reduces dependency, which allows us during the Covid-19 pandemic to compensate the developments between different end markets. Nevertheless, we acknowledge that S&T needs to better explain and communicate its technology developments and value proposition to the investor’s community.

3.

S&T’s complexity: We are aware that the IT legacy business in combination with our own technology solutions for various vertical end markets create a high level of complexity. Furthermore, we understand that the number of subsidiaries resulting from our M&A activities is too high. With our PEC program, started in summer 2019, we aim to reduce the number of entities and therefore complexity – a process we will even accelerate in the near future.

4.

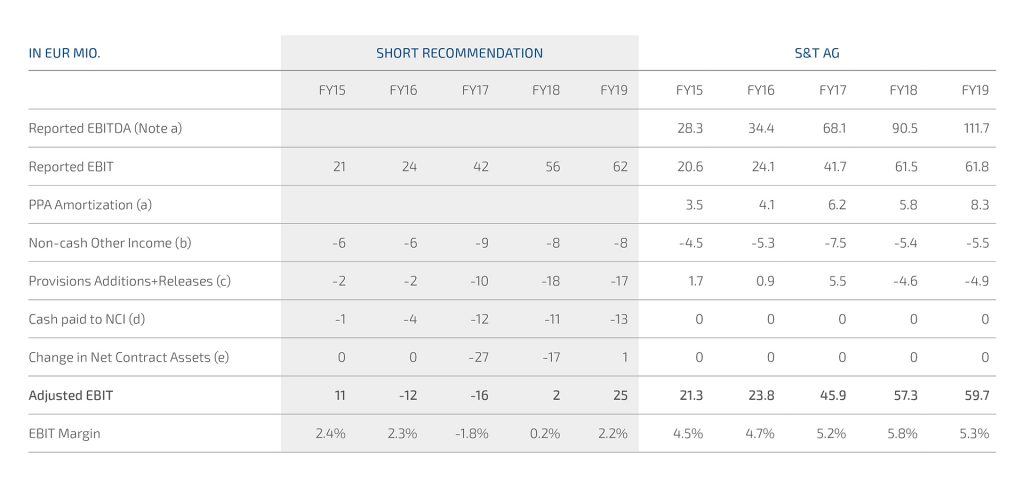

Operational Performance: The short recommendation states that adjusted operational EBIT margins are much lower than reported:

a) The short recommendation claims that EBITDA is not helpful to measure the operational performance of a company. We have a different view since EBITDA is a key figure for operational performance used by many stock-listed companies as it for example does not contain PPA amortizations (outline under line PPA Amortization) which are non-operating and non-cash effective.

b) The short analyst adjusted EBIT for non-cash other income – but not all other income is non-cash, as e.g. it contains rental income for sub-renting S&T premises, where we have the overall rental expenses in our P&L. Above we have therefore adjusted to the real non-cash other income, e.g. resulting in maximum of EUR 5,5 Mio. in 2019 compared to EUR 8 Mio. in the short recommendation.

c) The analyst adjusted in his short recommendation the EBIT for change in provisions, which he derives from the cash flow statement irrespective whether they do have a P&L effect or not. This is from our side a biased view; therefore, we have outlined above the net P&L impact from changes in the provisions considering the release and additions to the provisions via P&L.

d) Furthermore, the analyst adjusted the EBIT for payments due to the acquisition of non-controlling interests. These payments relate to acquisitions and are not operational.

e) It is unclear to S&T why the amount of the Net Contract Assets of minus 27 Mio. resulting from the first-time application of IFRS 15 in FY 2018, which represent only a change in the presentation on the balance sheet, shall be deducted from the reported EBIT. Especially, as the Contract Asset from Customer Contracts as of 31.12.2018 amounted to EUR 1,3 Mio. while the Contract Liabilities from Customer Contracts arrived at EUR 28,7 Mio. The overall EBIT impact from IFRS 15 in FY 2018 came to minus 81 TEUR.

By applying all “operational” adjustments in an objective manner, also considering negative P&L effects, the EBIT changes look significantly different than stated in the short recommendation.

5.

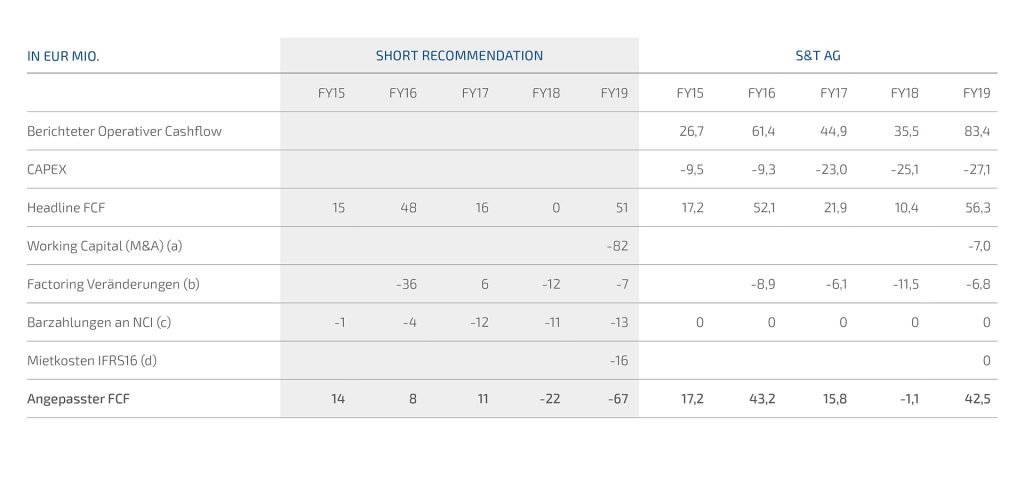

Financial performance: The short recommendation states that S&T is Free Cash Flow negative.

a) The Free Cash Flow (FCF) deviates slightly from the FCF stated in our Annual Reports, but that´s not our main point: The short recommendation deducts e.g. for FY 2019 all Trade Account Receivables and Contract Assets of acquired and first time consolidated companies (EUR 82 Mio.) from the FCF while not taking e.g. assumed Trade Payables into account. Taking for example a closer look to the quoted acquisition of Kapsch CarrierCom, S&T assumed Trade Account Receivables of EUR 35,7Mio. and Trade Payables of EUR 42,6Mio., resulting in a negative position of minus EUR 6,9 Mio. Even more, the overall assumed net assets at fair value at the time of first-time consolidation of Kapsch CarrierCom amounted to minus EUR 57,5 Mio., which is not considered in the short recommendation report. Furthermore, the methodology used in the short recommendation assumes that all Trade Account Receivables turn immediately into cash while no Trade Payables being paid and the acquired entities have zero Trade Account Receivables as of 31st of December 2019, which is not correct given their going concern. S&T AG calculated the cash flow contribution from acquired entities in 2019 on a stand-alone basis, which ends up taking properly into account the Inventories, Trade Receivables and Trade Payables, in a positive improvement of the FCF of EUR 7,0 Mio. Considering on top also the Contract Assets and Contract Liabilities, the FCF impact from all acquisitions would amount to minus EUR 3,9 Mio. in FY 2019.

b) The significant increase in Factored Receivables in FY 2016 resulted from an acquisition and from S&T perspective need to be excluded from FCF impact.

c) Cash paid to NCI is acquisition related and need to be excluded from the FCF which is by nature before M&A activities.

d) According to IFRS 16 expenses for leasing (including rental cost) are part of the Financing Cash Flow and therefore not part of the FCF.

As communicated by S&T, the cash conversion as well as the Working Capital development where not satisfying in the past, whereas we believe we made significant progress in 2019 and also in first half of the current financial year and see more possibilities to improve further. Nevertheless, we cannot share the view that S&T is FCF negative.

6.

S&Ts Financial Performance: the short recommendation adjusts the reported net cash 2019 of EUR 29,5 Mio. and outlines a net debt of EUR 202 Mio. In general, there is no clear definition of net debt. In S&T terms we calculate cash and cash equivalents (EUR 312,3 Mio) minus EUR 282,7 Mio. bank debt which results in EUR 29,5 Mio. net cash. While there is room for discussions how to see the non-recourse factoring and IFRS 16 (Leasing Liabilities), we think it would be only fair to consider other items such as prepayments made to subcontractors for services to be provided, which amounted for EUR 35,9 Mio. by 31st of December 2019, in the net debt calculation.

7.

Exposure to countries considered high-risk: it is correct that S&T is present in countries which might be considered higher risk, in some cases also with partial ownership structures, as such being named in the short recommendation Russia, Moldova and Belarus. While S&T Moldova and S&T Belarus provide IT Services on the local market, RT Soft in Russia is focused on Embedded Soft- and Hardware technologies, also serving as internal R&D centre for various S&T group companies, and selling directly to Western European subsidiaries. From S&T perspective, with a share of revenue in 2019 of 3,2% with customers in Russia, 1,4% with customers in Moldova (to increase due to full year consolidation of BASS in 2020) and 0,2% in Belarus, resulting in 4,8% revenue contribution from customers in these countries in 2019, S&T considers the potentially associated higher risk as not-substantial.

Furthermore, for various reasons such as customer perception or local support, S&T did and will maintain partial ownership structure in Russia and Moldova, being reflected in our P&L statement in the exclusion of the attributable net profit. When we look to the payment for non-controlling interests for the aforementioned subsidiaries in the FY 2019, dividends to non-controlling interests in the FY 2019 amounted for total S&T Group to 479 TEUR.

8.

Concerns about Kontron in Malaysia: Kontron Asia Pacific Design CDN BHD (“Kontron Malaysia”) is a subsidiary domiciled in Penang, Malaysia. Kontron Malaysia currently has app. 50 FTE and is an internal R&D centre focused on engineering for Kontron Group, being compensated internally on a cost-plus basis. Furthermore, Kontron Malaysia supports S&T´s global sourcing activities having better access to contract manufacturers in Asia.

The short recommendation includes two findings related to Kontron Malaysia:

- The first finding is related to a fraud case which occurred in 2010, long before the acquisition of Kontron AG by S&T AG in 2016. We would like to clarify that the current S&T Management was not involved in this case and took – after the acquisition of Kontron AG in 2016 – all possible measures to recover the previously lost amount. In 2019, a final decision by the Superior Court of Malaysia ruled the sole responsibility of the former Malaysian management in the respective fraud case and obliged them to compensate the damaged amount.

- Subsequent to the final award by the Malaysian court, the title for compensation against the old Kontron Malaysia Management has been legally transferred from Kontron Malaysia to Kontron (S&T) AG, allowing Kontron (S&T) AG as the D&O insurance contract holder to claim directly against the D&O Insurance, which is also domiciled in Germany. As compensation for the transferred claim against the D&O insurance, Kontron (S&T) AG waived in the similar amount as the expected compensation from the D&O insurance an intercompany loan granted from Kontron AG to Kontron Malaysia. This resulted in an extra-ordinary income for Kontron Malaysia in 2019, increasing the profit of Kontron Malaysia locally whereas having no impact on the operational performance of S&T Group overall. Therefore, the concern in the short recommendation that Kontron Malaysia generated the group´s highest margins likely due to charging technology fees to the other group subsidiaries, is not correct.

9.

EY as Auditor and Compliance related topics: The short recommendation sees Ernst & Young, Linz, Austria, given the role of Ernst & Young Germany as auditor of Wirecard AG or Ströer, in combination with Ernst & Young Linz as “regional office” being a long-time auditor of S&T AG, as risky: it is correct, that Ernst & Young is serving since more than 10 years as auditor of S&T. Therefore, based on European Regulation (2014/56/EU and Directive 537/2014) as well as the implemented Austrian Legislation, S&T has conducted a European-wide tender, where Ernst & Young qualified as best bidder. On the last Annual Shareholder Meeting on June 16th, 2020, the proposal of Ernst & Young has been accepted with a majority of ~96%. Furthermore, it is noteworthy from S&T perspective, that given the shareholding of Ennoconn Corporation in S&T AG, S&T´s quarterly reports are being reviewed and annual financial statements are being audited by Deloitte, Ennoconn´s Auditor, as part of Ennoconn´s financial statements. Nevertheless, the S&T Executive Board understand the concerns and will discuss it with the S&T Audit Committee short-term. Finally, in respect to the composition of the Audit Committee of S&T AG, the short recommendation relies on outdated information not considering the changes from June 16th, 2020.

Hannes Niederhauser, CEO: “S&T is taking the short recommendation very seriously. Our reporting is in full compliance with IAS/IFRS standards whereas the adjustments in the short recommendation seem from our perspective one-sided, partially overstated or in some points incorrect. On the other side, we share the criticism like the weak cash conversion, the development of the working capital or the complex organizational structure, that´s why we have started our “PEC Program” in summer 2019, showing first good successes, but still room for improvement. Our target is to further improve in these areas short term. Also, our aims to provide better transparency and a better understanding of our technology will go on. And last, but not least, we will continue and complete our transformation from an IT Services to a focused IoT technology company with utmost efforts as outlined in our Agenda 2023 and our upcoming Vision 2030, which we will present in January 2021.”